The CO2 Market 24.03.2020

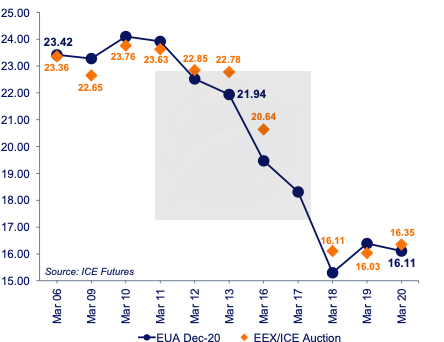

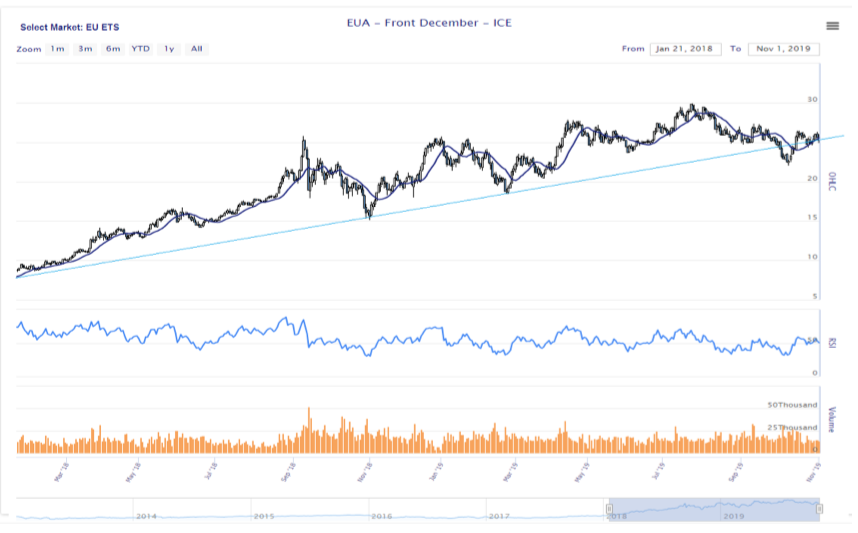

Last week, EUA prices witnessed a historic weekly crash of 27% and closed at a year and a half low of €15.54 on Monday, 23.03.2020.

Since the week prior, quarantine measures, travel restrictions, and business closures have significantly increased across the EU and will likely remain over the coming weeks at least. This has spurred fear of significant emission reductions to come in the EU market, causing the selling pressure to aggressively increase far beyond what the market buyers could handle.

EU states, UK hand out a further 8.5 mln free EUAs for 2020

EU member states and the UK handed out a further 8.5 million free carbon allowances to industrial emitters over the past two weeks, according to updated data released late Friday, 20.03, by the European Commission.

Germany indicates leniency in EU ETS compliance deadlines due to COVID-19 crisis

Germany will take into account instances where EU ETS compliance deadlines have not been met as a result of the coronavirus outbreak and could grant clemency in some cases, the government announced on Friday, 20.03.

Poland to push for emergency EU ETS changes if virus impact persists

Poland may propose emergency EU reforms including ETS changes, the country’s climate ministry told Polish state media on Thursday, 19.03, aiming to reduce the burden on its economy as it comes under intense strain due to the Coronavirus.

Source: Carbon Pulse and ClearNewMarkets, London