The Carbon Market

16.06.2014

The ICE exchage from London closed its operations on June 15:

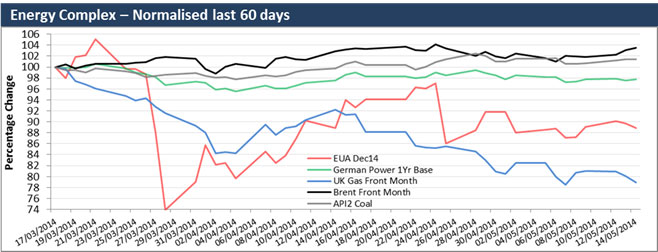

- EUA spot closed at € 5,65

- EUA DEC14 futures closed at € 5,68

- CER futures contract Dec14 closed at € 0,14

- Brent Crude Front Month closed at $ 113,04

- German Power Front Month closed at € 32,77

European CO2 Prices

The EU emissions trading scheme allowance market reached a seven week high, on continuing expectations that the EU will implement a long-term fix for the market’s oversupply.

A German government announcement that the country will support an early implementation of the European Commission proposed market stability reserve helped strengthen the price of the last week and at the beginning of this week.

But many market participants remain skeptical that the EU will implement the market reserve as early as Germany’s preferred start day of 2017, having seen that the short term backloading supply fix took almost two years to pass through the EU legislative process.

Source: Argus Media, June 2014.