Sweden and Malta’s Strategic Move in EU Emissions Trading – 20.08.2024

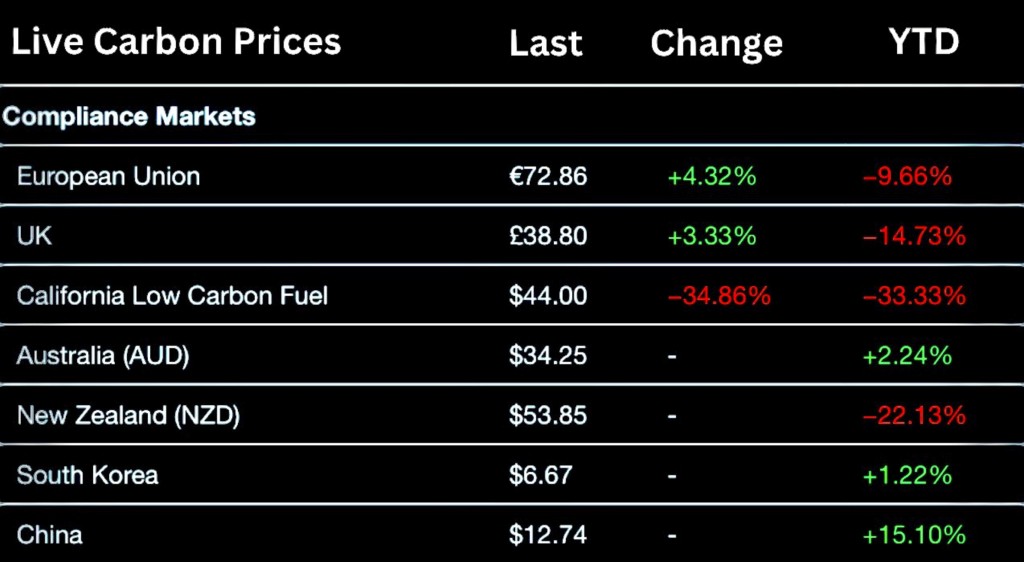

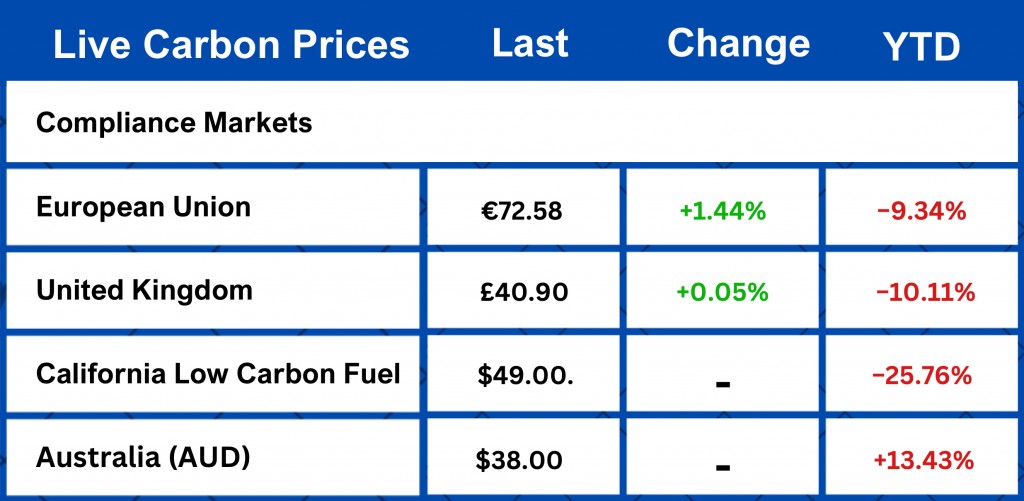

EUAs posted their third weekly gain in the last month, as modest buying activity was enough to counter active selling pressure, while trading volume shrank as participants headed into the peak summer weekend and UKAs snapped a run of six weekly losses.

Sweden and Malta’s Strategic Move in EU Emissions Trading

In a significant development for the European Union’s climate policy, Sweden and Malta have announced their intention to increase the number of European Union Allowances (EUAs) they plan to cancel under the EU Emissions Trading System (ETS) flexibility mechanism.

The ETS flexibility mechanism, which allows eligible EU member states to cancel a portion of their EUAs instead of auctioning them, was introduced to help countries meet their emission reduction targets under the Effort Sharing Regulation (ESR). The ESR focuses on sectors not covered by the EU ETS, such as transport, agriculture, and waste management, and requires a 40% reduction in these sectors by 2030 compared to 2005 levels.

This decision, which aligns with the EU’s broader targets for reducing greenhouse gas emissions, reflects the commitment of these nations to achieve their emission reduction targets from non-ETS sectors, yet not through concrete emission reduction solutions, but by making some compensations between the allocations distributed to the countries for the EU ETS sectors towards non-ETS sectors, which cannot otherwise fulfill their imposed targets.

Sweden, which had previously refrained from using this flexibility, now plans to cancel up to 5.2 million EUAs, while Malta has increased its cancellation target to 510,300 EUAs.

The timing of this announcement is critical. As the EU gears up for its ambitious 2030 climate targets, the flexibility provided by the ETS is seen as a vital tool for balancing economic growth with environmental responsibility. However, it also highlights the challenges faced by smaller nations like Malta, which must navigate the complex dynamics of the EU’s carbon market while maintaining their economic competitiveness. The introduction of new ETS regulations, particularly in the shipping sector, has raised concerns about the potential economic impact on Malta’s role as a major transshipment hub. The Malta Maritime Forum has warned that the increased costs associated with the EU ETS could lead to a significant loss of business to non-EU ports, particularly in North Africa, threatening Malta’s economic stability and connectivity.

These developments indicate a growing trend within the EU where member states are increasingly utilizing the flexibility mechanisms available to them to meet stringent climate goals while mitigating potential economic drawbacks. As Sweden and Malta move forward with their revised strategies, their actions will likely serve as a benchmark for other EU nations facing similar challenges.

Source: The European Commission, Carbon Credits, Ice.com, Carbon Pulse

Posted in: Uncategorized

Leave a Comment (0) →