The Carbon Market 31.03.2020

Prices increased

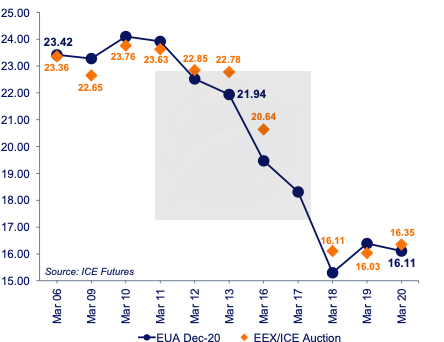

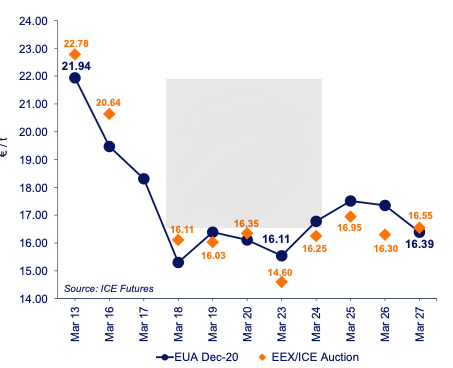

The EUA Dec-20 price closed at €17.06 on Monday, 30.03.2020 (+4.09% than Friday, 27.03.2020).

EUA Dec-20 increased by €0.28 last week and closed at €16.39 (+1.74%). Traded volumes decreased significantly compared to the previous week with 167.6Mt versus 278.2Mt exchanging hands on ICE across contracts. The total Open Interest increased by 16.1Mt 22.00 for a total of 889.8Mt.

No delay of the surrender deadline

Although the EU Commission announced on Thursday, 26.03.2020 that there will not be any postponement of the CO2 compliance deadline of the EU ETS installations, which remains on 30 April 2020, our forecast is bearish on this week due to weak market fundamentals and the spread of COVID-19.

Source: The European Commission, Brussels & ClearBlueMarkets, London

Posted in: Uncategorized

Leave a Comment (0) →