EU ETS and the Future of Carbon Pricing – 13.08.2024

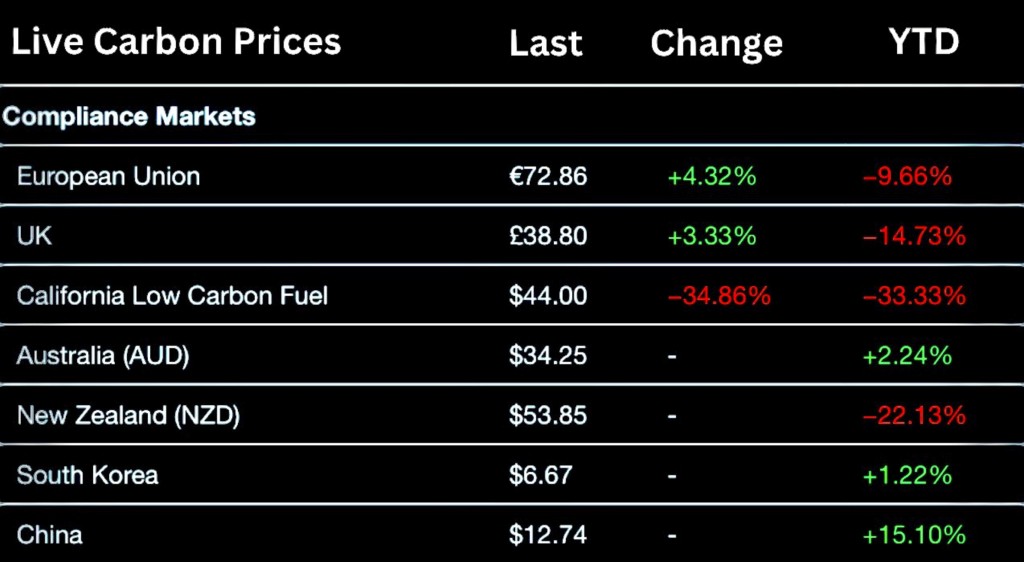

The Carbon Emissions Certificate (EUA) closely tracked the natural gas prices on the TTF (Title Transfer Facility) market on Thursday, August 8th, as they once again rebounded from an important technical resistance level before briefly surpassing it at the end of the session. The market struggled to find a clear direction on Friday, August 9th, due to low trading volumes during the summer and the lack of fundamental factors to influence the market. In contrast, Monday’s session on August 12th ended with a significant increase of 4.32% on the ICE ECX exchange compared to the end of last week, reaching a spot price of 72.86 Euro/tCO2.

Current State of the EU ETS

In 2023, the EU Emission Trading System (EU ETS) ended with a surplus of 2.27 billion emission allowances (EUAs), reflecting a continued trend of high surpluses driven by reduced electricity production and the growth of renewable energy. This surplus, slightly down from the approximately 2.4 billion EUAs in 2022, indicates the ongoing impact of policy interventions and increased renewable energy adoption. Despite these reductions, emissions remain below the system’s cap, allowing the surplus to continue. This surplus is distributed among various reserves, such as the Market Stability Reserve (MSR) and the New Entrants Reserve (NER), ensuring that a significant portion of EUAs remain outside circulation.

The European Commission’s MIX scenario aligned with the EU’s 2030 emission targets presents a different picture. Under this scenario, the surplus could shrink to less than 1.1 billion allowances by 2030. This shift hinges on a significant increase in electricity production to 3,153 TWh by 2030, driven by accelerated renewable energy capacity installation. The MIX scenario also forecasts more aggressive emission reductions across sectors like transport and heating, which would push demand for EUAs, narrowing the surplus and consequently increasing their price. Due to the entrance of these new into the EU ETS in 2026, the EUA certificate price is expected to exceed 100 Euro/tCO2.

The future of the EU ETS is deeply intertwined with the EU’s broader energy transition. As the EU moves towards its 2030 targets, careful consideration of supply and demand dynamics within the ETS will be crucial to ensuring a balanced, effective, and fair carbon market.

Source : European Comission, Carbon Pulse, Carbon Credits, Sandbag