IEA-IETA-EPRI Conference on Greenhouse Gas Emission Trade

Casiana Fometescu, international CO2 consultant attended on behalf of ALLCOT Group the IEA-IETA-EPRI annual workshop on Greenhouse Gas Emission Trade, which was held at the International Energy Agency (IEA) premises in Paris, from 3-4 October 2019.

“This year, I could definitely see that the importance of the CO2 market worldwide has been tremendously grown. The number of the people at the conference doubled then last year, especially from governments representatives (Great Britain, Switzerland, European Commission, China, New Zealand, Canada etc.)”, mentioned Casiana Fometescu, Carbon Expert. Mark Lewis from BNP also said that he feels “like in the glory days of the carbon”, looking to the great audience and the topics discussed.

The international carbon market has become such an extended topic since federal policies, regions, states and companies have developed policies to reduce emissions, and each of them have different technical details in implementation. The presentations held explained many sub-national trading schemes or carbon initiatives (Ontario, Quebec, California), national (New Zealand, China, Taiwan, Korea, Japan, Costa Rica, Columbia), and supra-national carbon markets (EU ETS).

Few Take Aways

1. The representative of the World Bank, Celine Ramstein, recognised the importance of putting a price on carbon and mentioned that there are 46 national and 30 subnational jurisdiction with either carbon trading schemes or carbon taxes implemented. Yet, all the emissions trading schemes (ETS) in the world (including China) comprise just 20% from the worldwide greenhouse gas (GHG).

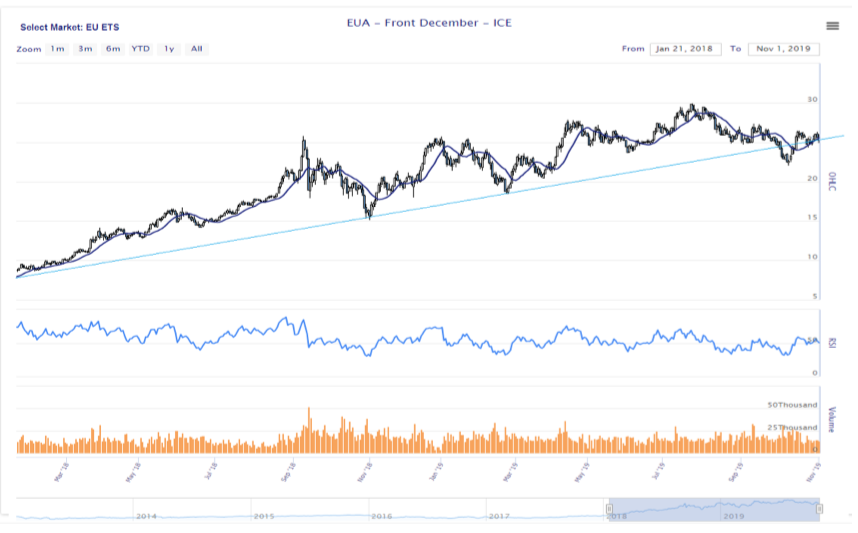

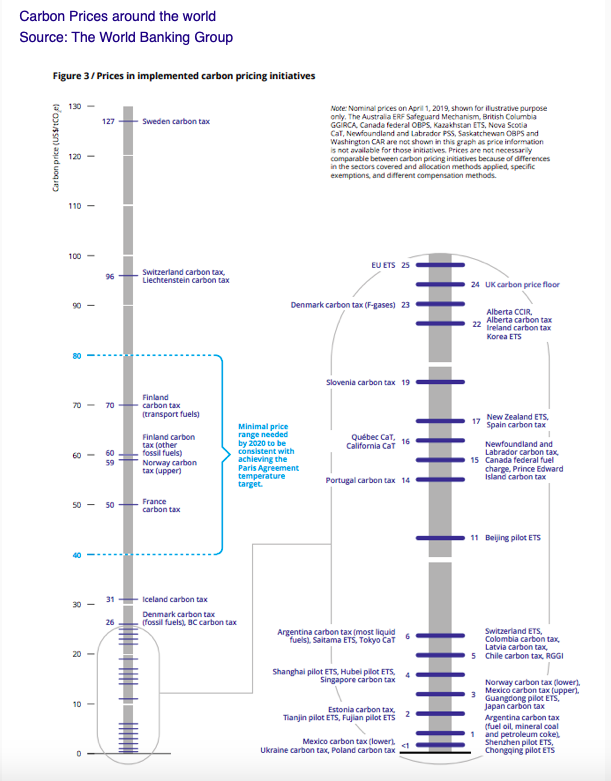

2. According to the last World Bank (WB) report on the state of the carbon market, there is a diversity of carbon prices in different countries, ranging from 127 Euro/tCO2 in Sweden to 96 Euro/tCO2 in Switzerland, 25 Euro/tCO2 in the EU ETS to less then 10 Euro/tCO2 in the most countries covered by carbon prices. Just 5% of the global GHG have carbon prices between 40-80 Euro/tCO2.

3. The worldwide carbon revenues by governments are also on rise from 22 billion USD in 2016 to 33 billion USD in 2017, and 45 billion USD in 2018, according to the WB.

4. The voluntary market trading volumes has been rising in the recent years and companies are increasingly looking to set CO2 targets in line with the Paris Agreements, UN Millennium Goals, and EU targets for 2030 and 2050.

5. The EU target of carbon neutrality in 2050 can be achieved only if governments reinforce their National Determined Contributions (NDCs), and put higher targets to achieve through carbon offsetting and implementation of green technology, renewable energy and carbon storage measures.

6. Germany would like to introduce a national sectorial trading scheme in addition to the mandatory EU ETS, which will comprise more activity sectors compared to the EU ETS.

7. China has been moving forward on the implementation of the national ETS finalising Phase I with the plan to realise Phase 2 “simulation exercises” before the end of this year.

8. Article 6 UN negotiations of the Paris Agreement can represent an opportunity for private entities to contribute to global mitigation efforts through their participation in international market mechanisms through voluntary cooperation in the implementation of the UN countries NDCs. Yet, all pilot initiatives under the Article 6 are government initiatives and not private ones.

9. IETA’s 2019 GHG Market Sentiment Survey shows that 85% of respondents expect corporate voluntary action to increase over the next 5-10 years with businesses much more involved in reducing GHGs emissions and achieving their voluntary targets.

For more information, please contact us.

Source: IEA-IETA-EPRI Conference, Paris, 3-4 October